42 zero coupon bond accrued interest

Asset swap - Wikipedia From the perspective of the asset swap seller, they sell the bond for par plus accrued interest ("dirty price"). The net up-front payment has a value 100-P where P is the full price of the bond in the market. Both parties to the swap are assumed to be AA bank credit … dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

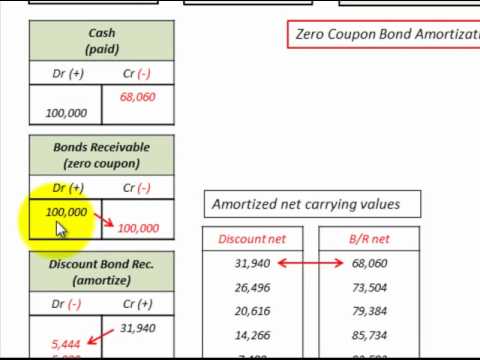

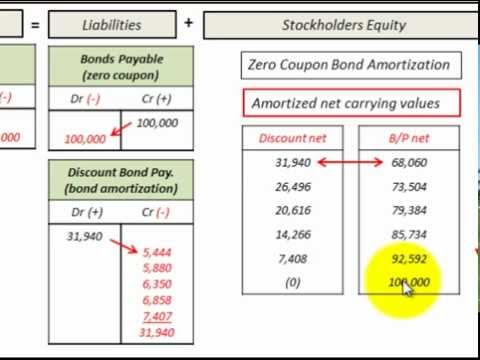

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

Zero coupon bond accrued interest

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Accrued Interest | What It Is and How It's Calculated For example, a zero-coupon bond maturing in 10 years and paying 4 percent interest would sell for approximately $6,755. Over the course of the next 10 years, the remaining $3,245 would accrue gradually until the bond matured, at which time the investor would be paid the full $10,000.

Zero coupon bond accrued interest. Dirty price - Wikipedia To avoid the impact of the next coupon payment on the price of a bond, this cash flow is excluded from the price of the bond and is called the accrued interest. In finance , the dirty price is the price of a bond including any interest that has accrued since issue of the most recent coupon payment. Chapter 6 -- Interest Rates Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of the bond is $910.00. What should be YTM for the bond? YTM = 3.64%*2 = 7.28% (3) Yield to call: the return from a bond if it is held until called Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. Accrued Interest - Bond Dirty Price vs. Clean Price On each ex-coupon date, the accrued interest drops to a very slightly negative value before gradually rising again. Of course, if a bond trade settles exactly on the coupon date, you don't use either formula [2] or [3]. There is zero accrued interest, and the dirty price equals the clean price. How to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Since the last coupon was issued, there have been 119 days of accrued interest. Thus the accrued interest = 5 x (119 ÷ (365 ÷ 2) ) = 3.2603. The Bottom Line

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Zero-Volatility Spread (Z-spread) - Investopedia Oct 10, 2020 · Zero-Volatility Spread - Z-spread: The Zero-volatility spread (Z-spread) is the constant spread that makes the price of a security equal to the present value of its cash flows when added to the ... Accrual Bond Definition - Investopedia Key Takeaways An accrual bond defers periodic interest payments usually until maturity, much like a zero coupon bond, except the coupon rate is fixed to the principal value. Accrual bond interest... Accrued Interest and the Bond Market - Investopedia In this case, the bond would be $50 over the entire year ($1,000 x 5%), and investor A held the bond for 90 days which is a quarter of the recorded year, or 25% (calculated by 90/360). So, the...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Unlike other bonds or debentures, investment in zero coupon bonds does not give any periodic return. Therefore, annual interest cannot be taxed on accrual basis in this case like other bonds or debentures. Under Income Tax Act, gains on sale of any securities shall be taxable as long term or short-term capital gains depending on the holding period. Zero-Coupon Bonds: Definition, Formula, Example ... - CFAJournal A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder ...

Zero-Coupon Bond - Fincyclopedia A bond that accrues interest over its life. Accrued interest is only payable at the maturity date of the bond. More specifically, a zero coupon bond (or simply, zero) doesn't pay interest during its life, but rather it is typically sold to investors at a deep discount from its face value (i.e., the amount a bond will be worth at its maturity or due date).

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

› ~zz1802 › Finance 303Chapter 6 -- Interest Rates Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually. The market price of the bond is $910.00. What should be YTM for the bond? YTM = 3.64%*2 = 7.28% (3) Yield to call: the return from a bond if it is held until called Example: a 10-year bond carries a 6% coupon rate and pays interest semiannually.

xplaind.com › 606456Clean Price (Flat Price) of a Bond | Formula & Example Apr 30, 2019 · Accrued interest is added back to the quoted price to determine the settlement price i.e. the consideration that buyer pays to the seller in exchange of the bond. Formula. If we have dirty price and accrued interest values for a bond, we can find the clean price using the following formula: Clean Price = Dirty Price − Accrued Interest

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep On the date of maturity - when the zero-coupon bond "comes due" - the bondholder is entitled to receive a lump-sum payment equal to the initial investment amount plus the accrued interest. Therefore, zero-coupon bonds consist of just two cash flows: Purchase Price: The bond's market price on the date of purchase (cash inflow to bondholder)

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years.

Accounting for Zero-Coupon Bonds - GitHub Pages Because zero-coupon bonds are widely issued, some form of interest must be included. These bonds are sold at a discount below face value with the difference serving as interest. If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt.

Tax Considerations for Zero Coupon Bonds - Financial Web With a zero coupon bond, you are not paid any interest over the life of the bond. At the end of the bond, you get the face value of the bond. The difference with this type of bond is that you can buy the bond at a serious discount to what its end value is. For example, you may only pay 70 to 80 percent of the value of the bond when you buy it.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

› articles › investingHow to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · Since the last coupon was issued, there have been 119 days of accrued interest. Thus the accrued interest = 5 x (119 ÷ (365 ÷ 2) ) = 3.2603. The Bottom Line

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Taxation on Phantom Interest: Zero-coupon bonds do not pay any interest to investors. However, the interest does accrue over the years. Now, investors may have to wait long term to receive their share of the interest. However, governments do not want to wait for receiving their share of taxes.

› terms › zZero-Volatility Spread (Z-spread) - Investopedia Oct 10, 2020 · Zero-Volatility Spread - Z-spread: The Zero-volatility spread (Z-spread) is the constant spread that makes the price of a security equal to the present value of its cash flows when added to the ...

Zero Coupon Bonds | Alamo Capital Buy Zero Coupon Bonds. If you are interested in buying zero coupon bonds, contact Alamo Capital by phone at (877) 682-5266 - or - (877) 68-ALAMO, by email at information@alamocapital.com, or by filling out the form below. Our experienced zero coupon bond specialists can provide you with information about the current inventory of zero coupon ...

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Because zero-coupon bonds are widely issued, some form of interest must be included. These bonds are sold at a discount below face value with the difference serving as interest. If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt.

Imputed Interest - Overview, Calculation, Tax Implications In filing tax returns, zero-coupon bonds are required to declare the imputed interest. The imputed interest for the year on zero-coupon bonds is estimated as the accrued interest rather than the minimum interest like in below-market loans. It is calculated as the yield to maturity (YTM) multiplied by the present value of the bond. The value of ...

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until maturity If...

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Zero-Coupon Bond - Definition, How It Works, Formula Example of a Zero-Coupon Bonds Example 1: Annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53

Post a Comment for "42 zero coupon bond accrued interest"