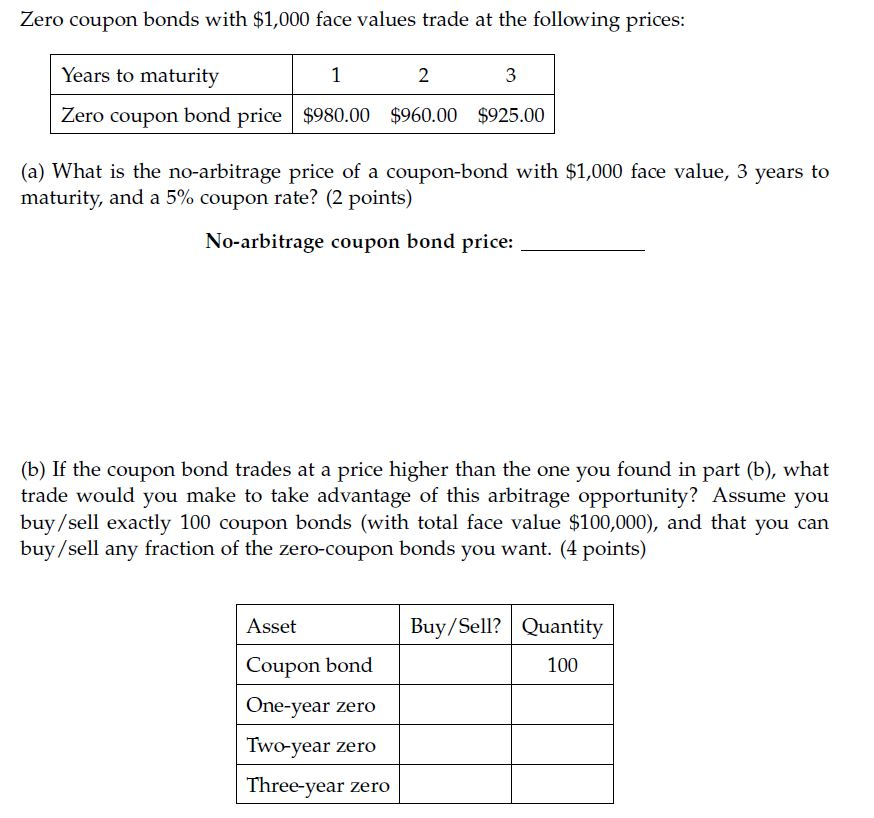

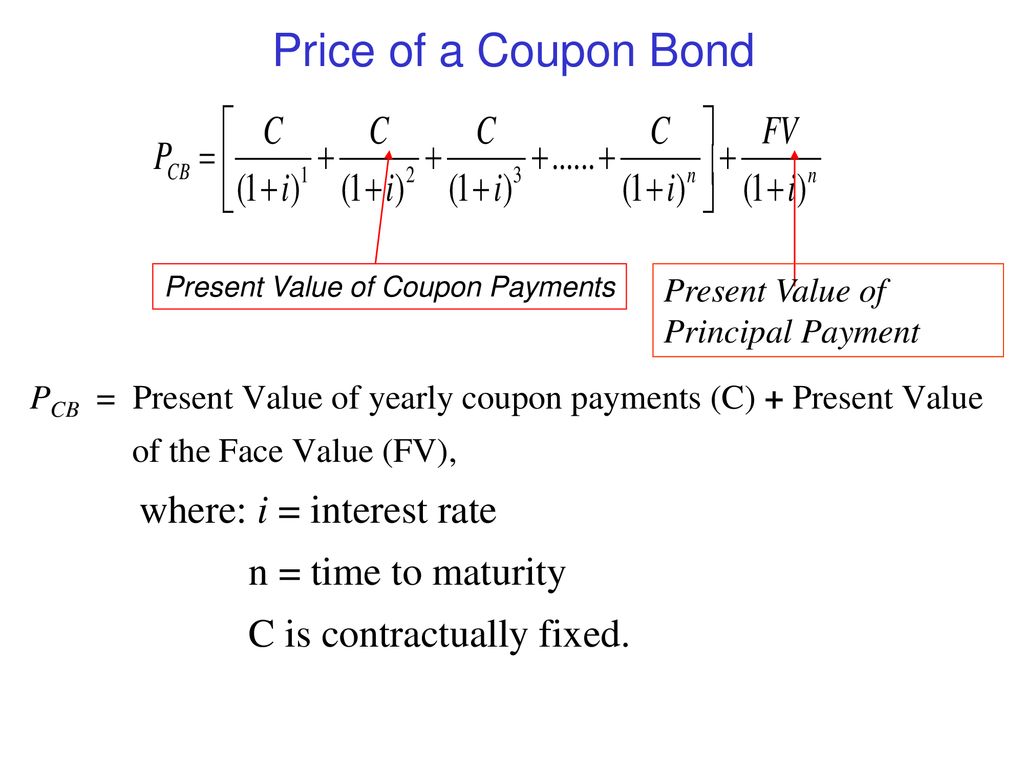

41 price of coupon bond

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to achieve an equivalent return. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment.

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond.

Price of coupon bond

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Rate of a Bond - WallStreetMojo It is to be noted that the coupon rate is calculated based on the bond’s face value or par value, but not based on the issue price or market value. It is quintessential to grasp the concept of the rate because almost all types of bonds pay annual interest to the bondholder, which is known as the coupon rate. Bond Price Calculator | Formula | Chart 20.6.2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the …

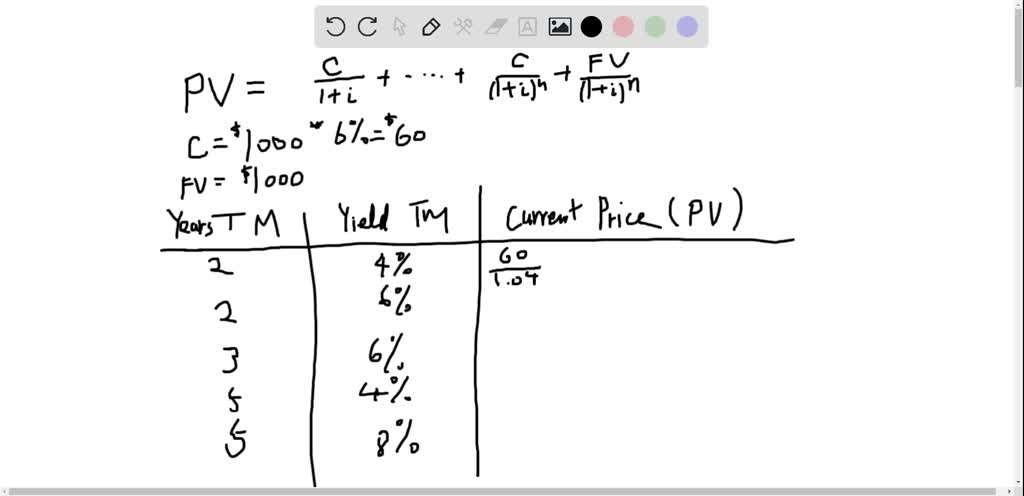

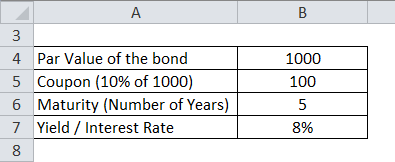

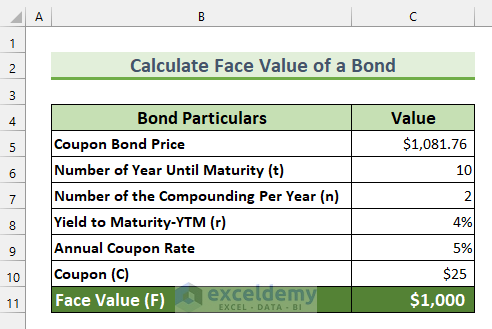

Price of coupon bond. Bond Pricing - Formula, How to Calculate a Bond's Price First, let's find what the coupon payment is: Coupon Payment = (0.05 / 2) * 100 = $2.50. In this calculation, the coupon rate is divided by 2 to represent the semi-annual coupon, and this is multiplied by the face value of the bond. The coupon payment comes out to $2.50. Bond Price Calculator This bond price calculator estimates the bond’s expected selling price by considering its face/par value, coupon rate and its compounding frequency and years until maturity. The C ... Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond’s par value. Coupon rate compounding frequency that can be ... How to Calculate Bond Price in Excel (4 Simple Ways) The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation As mentioned earlier, you can calculate the bond price using the conventional formula. Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6)) How To Find Coupon Rate Of A Bond On Financial Calculator The current bond price and coupon rate calculate the bond's yield to maturity. How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay ...

BONDS | BOND MARKET | PRICES | RATES | Markets Insider Get all the information on the bond market. Find the latest bond prices and news. ... The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the ... › documents › excelHow to calculate bond price in Excel? - ExtendOffice Let’s say there is a annul coupon bond, by which bondholders can get a coupon every year as below screenshot shown. You can calculate the price of this annual coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key. See screenshot: Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $932 Therefore, the current market price of each coupon bond is $932, which means it is currently traded at discount (current market price lower than par value). Coupon Bond Formula - Example #2 Let us take the same example mentioned above. › finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life. You can see how it changes over time in the bond price chart in our calculator.

Zero-Coupon Bond - Definition, How It Works, Formula 28.1.2022 · The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? 5*2 = $781.20. The price that John will pay ... Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Coupon Payment Calculator How to calculate bond coupon payment? Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates. dqydj.com › bond-convexity-calculatorBond Convexity Calculator – Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

› terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Zero-Coupon Bond Yield Example Calculation In our next section, we'll work backward to calculate the yield-to-maturity (YTM) using the same assumptions as before. Model Assumptions

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as …

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Bond Price Calculator - Belonging Wealth Management If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon payments. The calculator will make the necessary adjustments to your annual coupon if you select this option.

Tata Capital Housing Finance Limited - Bond Price, Yield Percentage ... A bond that pays a fixed coupon will see its price vary inversely with interest rates. This is because bond prices are intrinsically linked to the interest rate environment in which they trade for example - receiving a fixed interest rate, of say 8% is not very attractive if prevailing interest rates are 9% and become even less desirable if ...

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

› finance › Bond-PriceBond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A $1,000 bond has a face value of $1,000. If its coupon rate is 1%, that means it pays $10 (1% of $1,000) a year. Coupon rates are largely influenced by prevailing national government-controlled...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase price of the bond, its nominal return over its duration & its yield to maturity. Entering Years: For longer duration bonds enter the number of years to maturity.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

How to calculate bond price in Excel? - ExtendOffice Let’s say there is a annul coupon bond, by which bondholders can get a coupon every year as below screenshot shown. You can calculate the price of this annual coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key. See screenshot:

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market.

Bond Price Calculator - Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The price of each bond is calculated using the below formula as, Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM.

consider a bond with a 6 annual coupon and a face value of 1000 complete the following table what re

Calculate Price of Bond using Spot Rates - AnalystPrep 27.9.2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

[Relationship between coupon rate and yield is inverse] | [Knowledge ... Bond Price = Coupon Rate / (1 + YTM)^n + Par Value / (1+YTM)^n. This formula shows that the relationship between coupon rate and yield is inverse. If coupon rates increase, then the price of the ...

Zero-Coupon Bond Definition - Investopedia 31.5.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Bond Convexity Calculator – Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Bond Price Calculator | Formula | Chart 20.6.2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the …

Coupon Rate of a Bond - WallStreetMojo It is to be noted that the coupon rate is calculated based on the bond’s face value or par value, but not based on the issue price or market value. It is quintessential to grasp the concept of the rate because almost all types of bonds pay annual interest to the bondholder, which is known as the coupon rate.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

![Solved Problem 1 [2pts] Suppose the prices of zero-coupon ...](https://media.cheggcdn.com/media/d09/d093474f-60fc-4291-942a-83c299f0ed41/phpKFnTMF)

Post a Comment for "41 price of coupon bond"