44 define zero coupon bond

Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Yield spread - Wikipedia In finance, the yield spread or credit spread is the difference between the quoted rates of return on two different investments, usually of different credit qualities but similar maturities.It is often an indication of the risk premium for one investment product over another. The phrase is a compound of yield and spread.. The "yield spread of X over Y" is generally the annualized …

Bold Looks. Zero F*cks. – XMONDO HAIR BDSM Slick & Define Balm. Regular price $25 Add to cart. x3-homepage-top-mobile. Quick Shop. BDSM Slick & Define Balm. Regular price $25 ... Recalibrate Bond Repair Conditioner. Regular price $25 Add to cart. Quick Shop. Project X Detox Shampoo. Regular price $25 ...

Define zero coupon bond

Types of Bonds - Basics of Bond, General Features and ... - BYJUS Zero-Coupon Bond: When the coupon rate is zero and the issuer is only applicable to repay the principal amount to the investor, such type of bonds are called zero-coupon bonds. Serial Bond: When the issuer continues to pay back the loan amount to the investor every year in small instalments to reduce the final debt, such type of bond is called ... Nation Thailand news website, thai news, thailand news ... Sep 03, 2022 · For the second time in a week, Nasa on Saturday aborted an attempt to launch its giant, next-generation rocketship, citing a stubborn fuel leak that the space agency said could delay the debut mission of its moon-to-Mars Artemis program by at least several weeks. Warrant (finance) - Wikipedia In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Both are discretionary and have expiration dates. They differ mainly in that warrants are ...

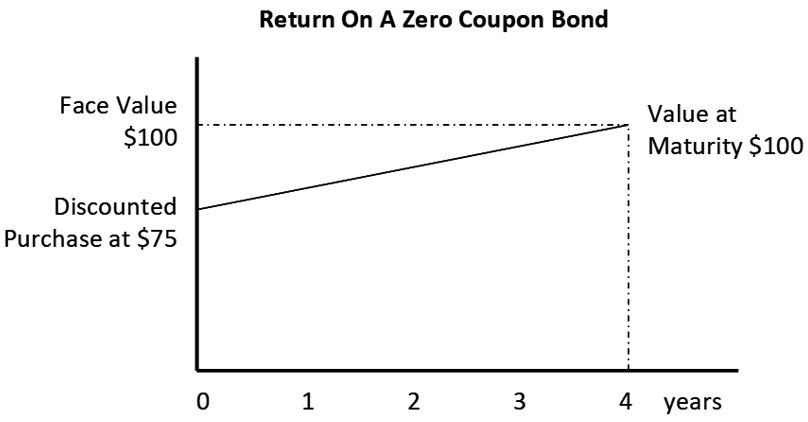

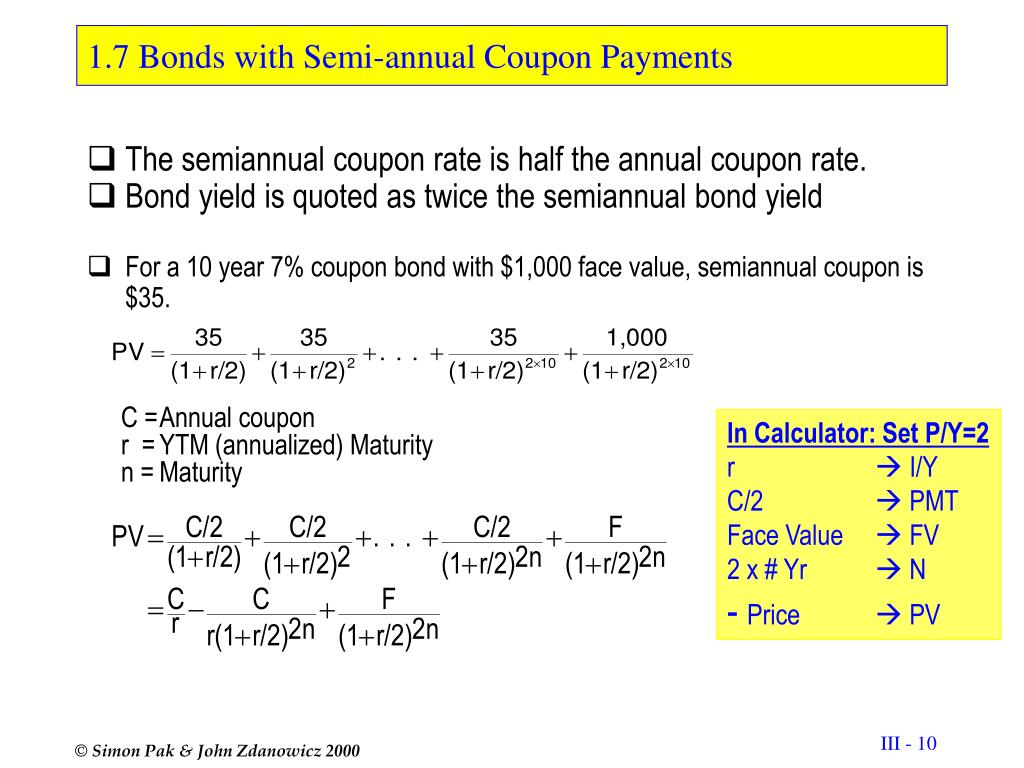

Define zero coupon bond. Bootstrapping Zero Curve & Forward Rates Oct 22, 2016 · The discounted cash flows & zero rates for later tenors will be solved for using the par bond assumption and the zero rates derived for the earlier tenors. This is illustrated in the steps that follow. 5. Let us start with the shortest tenor bond, the 0.25 year bond. Its cash flows are coupon and principal payable at maturity of 101.0075. Bond Definition: What Are Bonds? – Forbes Advisor Aug 24, 2021 · Coupon: The fixed rate of interest that the bond issuer pays its bondholders. Using the $1,000 example, if a bond has a 3% coupon, the bond issuer promises to pay investors $30 per year until the ... Achiever Papers - We help students improve their academic ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Answered: Define each of the following terms:c.… | bartleby A: A zero-coupon bond is also known as accrual bond because a zero coupon bond doesn't pay the coupon… Q: The discount bond sells for ____________ as maturity approaches. A: Bond is a debt instrument issued by companies and government.

What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... オンラインゲーム総合サイト mmorpg、fps、ブラウザゲーム等の情報が満載!オンラインゲームレビューやオンラインゲームランキングもあります。 Convexity of a Bond | Formula | Duration | Calculation Convexity is a risk management tool used to define how risky a bond is as more the convexity of the bond; more is its price sensitivity to interest rate movements. ... a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words ... Adjunct Members | Institute Of Infectious Disease and ... Adjunct membership is for researchers employed by other institutions who collaborate with IDM Members to the extent that some of their own staff and/or postgraduate students may work within the IDM; for 3-year terms, which are renewable.

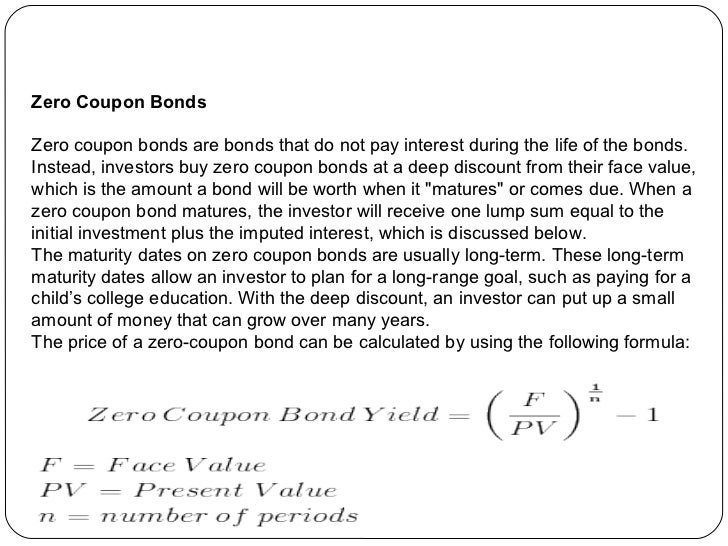

Zero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. Warrant (finance) - Wikipedia In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Both are discretionary and have expiration dates. They differ mainly in that warrants are ... Nation Thailand news website, thai news, thailand news ... Sep 03, 2022 · For the second time in a week, Nasa on Saturday aborted an attempt to launch its giant, next-generation rocketship, citing a stubborn fuel leak that the space agency said could delay the debut mission of its moon-to-Mars Artemis program by at least several weeks. Types of Bonds - Basics of Bond, General Features and ... - BYJUS Zero-Coupon Bond: When the coupon rate is zero and the issuer is only applicable to repay the principal amount to the investor, such type of bonds are called zero-coupon bonds. Serial Bond: When the issuer continues to pay back the loan amount to the investor every year in small instalments to reduce the final debt, such type of bond is called ...

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://blogger.googleusercontent.com/img/proxy/AVvXsEgMBqvsuQ1V_Kj2ORZwJUwBzc39HKmihKOYGxZrb0RVc7ZxiYmXfo-XwJjAHgRRoe9bh8OpA6CYfi2um3FQxQ7JZcD3XVl2Qz_ZFwMvEIXeL06l-sOoFrxgfAJpDtBNhMqT46LehetXrBhu8h3hKhm-JC7OrLWA4dPxPfftIkYBQQl50xpaDvwfipmZg92i0w=s0-d)

Post a Comment for "44 define zero coupon bond"