38 irs quarterly payment coupon

DOR Estimated Tax Payments | Mass.gov Unlike estimated payment vouchers, which have specific quarterly due dates, standard payment vouchers should only be used to submit a payment due with a tax return or amended tax return. Use a payment voucher when you are sending a paper check to DOR but your tax return has been filed electronically. Third quarter estimated tax payments due Sept. 15 IR-2020-205, September 9, 2020. WASHINGTON — The Internal Revenue Service today reminded the self-employed, investors, retirees and others with income not subject to withholding that third quarter estimated tax payments for 2020 are due September 15. Taxes are paid as income is received during the year through withholding from pay, pension or ...

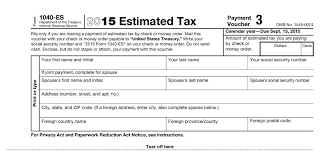

› estimated-income-tax-paymentsEstimated Income Tax Payments for 2022 and 2023 - Pay Online Sep 08, 2022 · The IRS may apply a penalty if you didn’t pay enough estimated taxes for the year, you didn’t pay the required estimate amount, or didn't pay on time. Form 1040-ES and Payment Methods You can make 1040-ES estimated tax payments online at the IRS , thus there is no need to e-File Form 1040-ES for the any of the quarters.

Irs quarterly payment coupon

How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ... home.treasury.gov › newsPress Releases | U.S. Department of the Treasury September 21, 2022 Biden-Harris Administration Announces Over $8.28 Billion in Investments in Community Development Financial Institutions and Minority Depository Institutions through the Emergency Capital Investment Program PDF 2022 Form OW-8-ES Oklahoma Individual Estimated Tax Year 2021 Worksheet ... After this estimated tax payment is processed, you will receive a pre-printed coupon each quarter. Please use the pre-printed coupon to make further tax payments. Name Address City State IP 2022 Mail this coupon, along with payment, to: Oklahoma Tax Commission - PO Box 269027 - Oklahoma City, OK 73126-9027

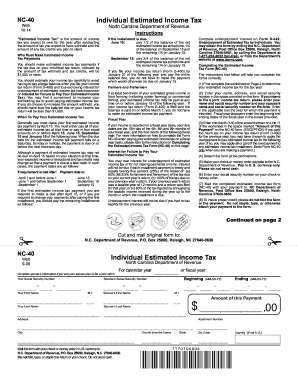

Irs quarterly payment coupon. 2022 Sales & Use Tax Forms - Michigan 2022 Purchasers Use Tax Return: 5088: 2022 Seller's Use Tax Return: 5089: 2022 Concessionaire's Sales Tax Return and Payment: 5092: 2022 Sales, Use and Withholding Taxes Amended Monthly/Quarterly Return: 5094: 2022 Sales, Use and Withholding Payment Voucher: 5095: 2022 Sales, Use and Withholding Monthly/Quarterly and Amended Monthly/Quarterly ... DES: Quarterly Tax Payment Voucher - English - NC Quarterly Tax Payment Voucher. DES Central Office Location: 700 Wade Avenue Raleigh, NC 27605 Please note that this is a secure facility. 2022 1040-ES Form and Instructions (1040ES) - Income Tax Pro Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the quarterly due dates for the 2022 tax year: April 18, 2022 June 15, 2022 September 15, 2022 January 17, 2023 Each quarterly estimated tax payment should be postmarked on or before the quarterly due date. Montana Individual Income Tax Payment Voucher (Form IT) Montana Individual Income Tax Payment Voucher (Form IT) 2021: 30-12-2021 11:47: Download: Available in our TransAction Portal (TAP)?mdocs-file=55943. Contact Customer Service ... You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan.

› tax-center › irsLearn More About Estimated Tax Form 1040 ES | H&R Block Use the Electronic Federal Tax Payment System (EFTPS) to submit payments electronically. Visit or call 1-800-555-4477. You can make payments weekly, monthly, or quarterly. You can schedule payments up to 365 days in advance. You can learn more about credit card options at . Payment Vouchers - Michigan Below are the vouchers to remit your Sales, Use and Withholding tax payment(s): 2022 Payment Voucher. 2021 Payment Voucher . 2020 Payment Voucher. 2019 Payment Voucher. 2018 Payment Voucher. 2017 Payment Voucher. 2016 Payment Voucher. 2015 Payment Voucher Do you need to pay quarterly taxes? What you need to know So if you owed $5,000 in taxes, you'll need to pay at least $5,500 in total quarterly payments to avoid a penalty. If your income this year is the same or higher than last year, the 100% prior-year safe harbor is the easiest and safest strategy for figuring estimated tax. No computations are needed. DOR: Estimated Tax You didn't make any estimated tax payments; You didn't pay enough estimated tax; You didn't make your payments on time; or; The total of your credits, including estimated tax payments, is less than 90% of this year's tax due or 100% of last year's tax due (110% of last year's tax if your federal adjusted gross income is more than ...

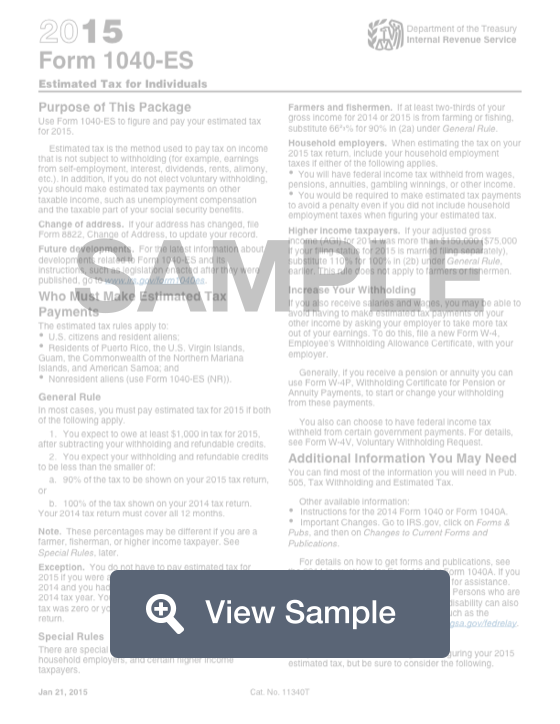

DOR Form 1-ES Wisconsin Estimated Income Tax Interactive Voucher Taxpayer · Spouse · Address · This payment is for tax period: · *Check the box below which applies to you. A Guide to Paying Quarterly Taxes - TurboTax Tax Tips & Videos The 100% requirement increases to 110% if your adjusted gross income exceeds $150,000 ($75,000, if you're married and file separately). One exception applies to individuals who earn at least two-thirds of their income from farming or fishing. The requirement is to pay in two-thirds of your current year tax or 100% of your prior year tax. Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax) About Form 1040-ES, Estimated Tax for Individuals Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you do not elect voluntary withholding, you should make estimated tax payments on other taxable ...

For those who make estimated federal tax payments, the first quarter ... IR-2022-77, April 6, 2022 WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others that the payment for the first quarter of 2022 is due Monday, April 18.

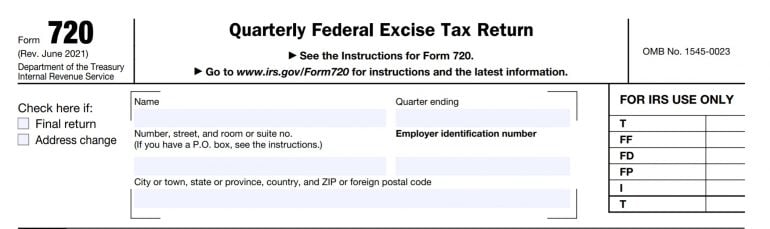

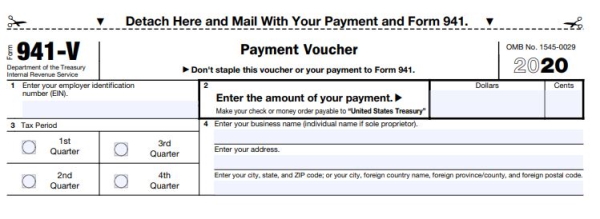

Payments | Internal Revenue Service - IRS tax forms Pay your taxes, view your account or apply for a payment plan with the IRS. ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation Form 9465; Installment Agreement Request POPULAR FOR TAX PROS; Form 1040-X; Amend/Fix Return ...

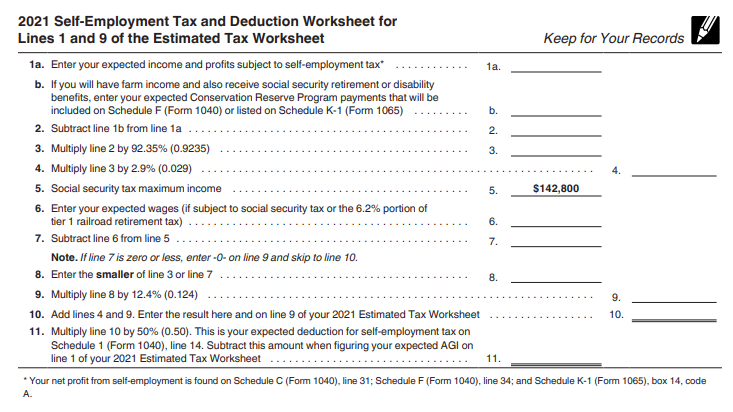

2022 Federal Quarterly Estimated Tax Payments | It's Your Yale 100% of the tax shown on your 2021 federal tax return (only applies if your 2021 tax return covered 12 months - otherwise refer to 90% rule above only). To calculate your federal quarterly estimated tax payments, you must estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the calendar year 2022.

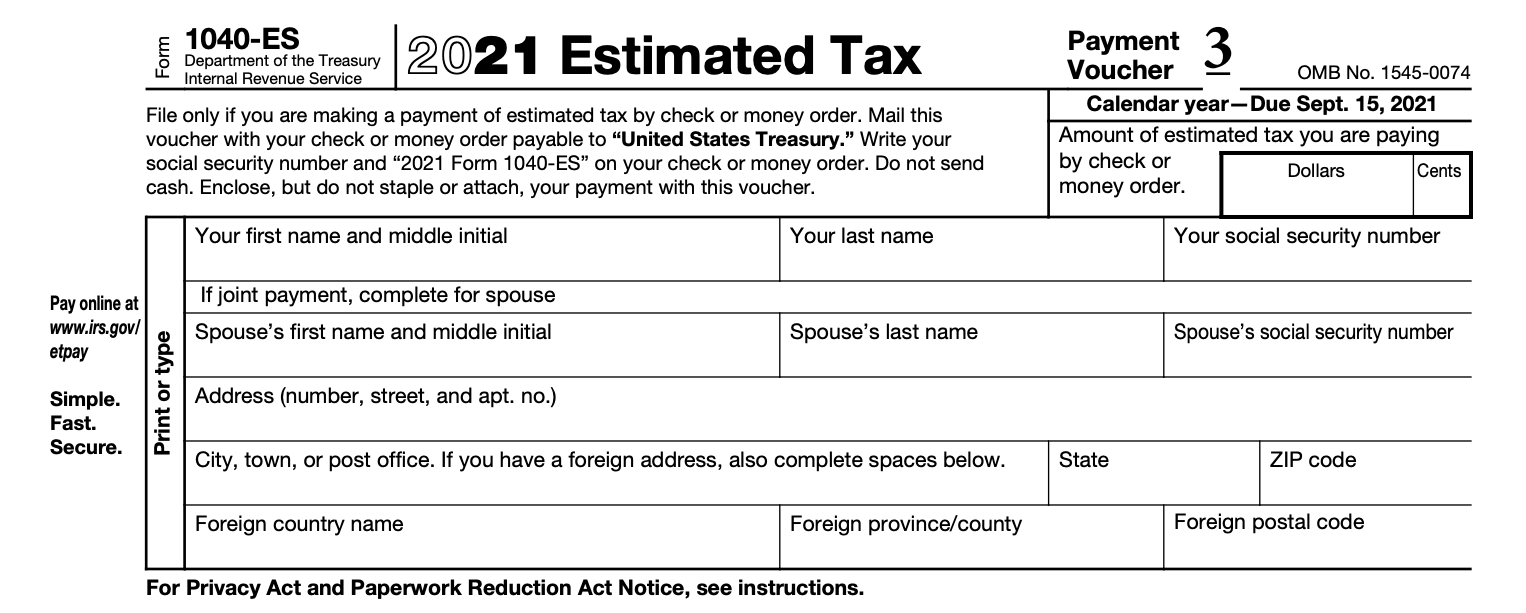

2021 Form 1040-ES - IRS You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and mail it with ...

2022 Form 1040-ES (NR) - IRS Mar 1, 2022 ... You can make more than four estimated tax payments. To do so, make a copy of one of your unused estimated tax payment vouchers, fill it in, and ...

When Are Quarterly Taxes Due in 2022? Dates to Bookmark - Business Insider Maskot/Getty. Some self-employed workers and independent contractors have to pay quarterly taxes. The remaining due dates for 2022 earnings are September 15, 2022, and January 17, 2023. If you ...

Payment Vouchers | Arizona Department of Revenue - AZDOR Arizona Individual Income Tax payment Voucher for Electronic Filing (This form has no separate instructions) Payment Vouchers. MET-1V. Arizona Marijuana Excise Tax Return Efile Return Payment Voucher. Payment Vouchers. TPT-V. Arizona Transaction Privilege Tax Efile Return Payment Voucher. Small Business Income Forms. AZ-140V-SBI.

Florida Employer's Quarterly Report with Payment Coupon - TaxFormFinder We last updated the Employer's Quarterly Report with Payment Coupon in January 2022, so this is the latest version of Form RT-6, fully updated for tax year 2021. ... Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the SSN/EIN of ...

Individual Estimated Tax Payment Form - AZDOR Individual Estimated Tax Payment Form. Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment; a partnership or S corporation mailing a voluntary estimated payment on behalf of its nonresident individual partners/shareholders participating in the filing of a composite return.

Estimated Taxes | Internal Revenue Service - IRS tax forms Coronavirus Aid, Relief, and Economic Security (CARES) Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020.

› pub › irs-pdfForm 941 for 2022: Employer’s QUARTERLY Federal Tax Return Form 941 for 2022: (Rev. June 2022) Employer’s QUARTERLY Federal Tax Return Department of the Treasury — Internal Revenue Service 950122. OMB No. 1545-0029

Estimated Tax | Internal Revenue Service Mailing your payment (check or money order) with a payment voucher from Form 1040-ES; Using Direct Pay; Using EFTPS: The Electronic Federal Tax Payment System ...

About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR.

Estimated Quarterly Tax Payments: 1040-ES Guide & Dates - TaxCure You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online. Before making a payment, you need to sign up for the service. Sign up online, or call the above phone number to have a signup form mailed to you. You need your name, Social Security number, and bank account details for online enrollment.

PDF 2022 IL-1040-ES Estimated Income Tax Payment for Individuals - Illinois Worksheet, Line 11, on the "Amount of payment" line. Detach the voucher, and enclose it with your payment. Print . your Social Security number(s), tax year, and "IL-1040-ES" on your payment. Mail both to the address shown on the voucher. Complete . your Record of Estimated Tax Payments on the next page. Form IL-1041, IL-1065, and IL ...

› pub › irs-pdf2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding,

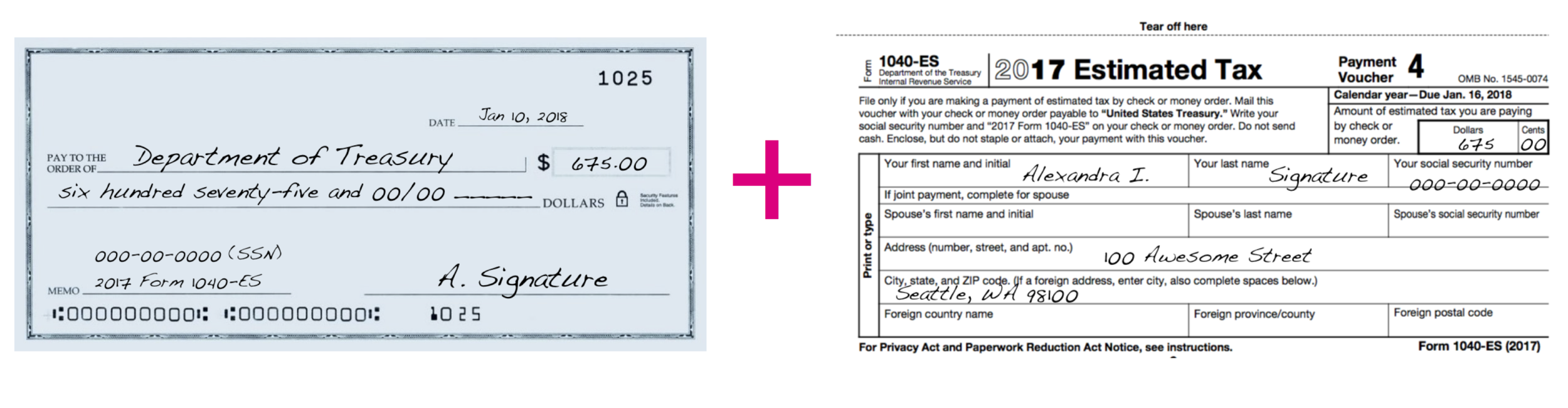

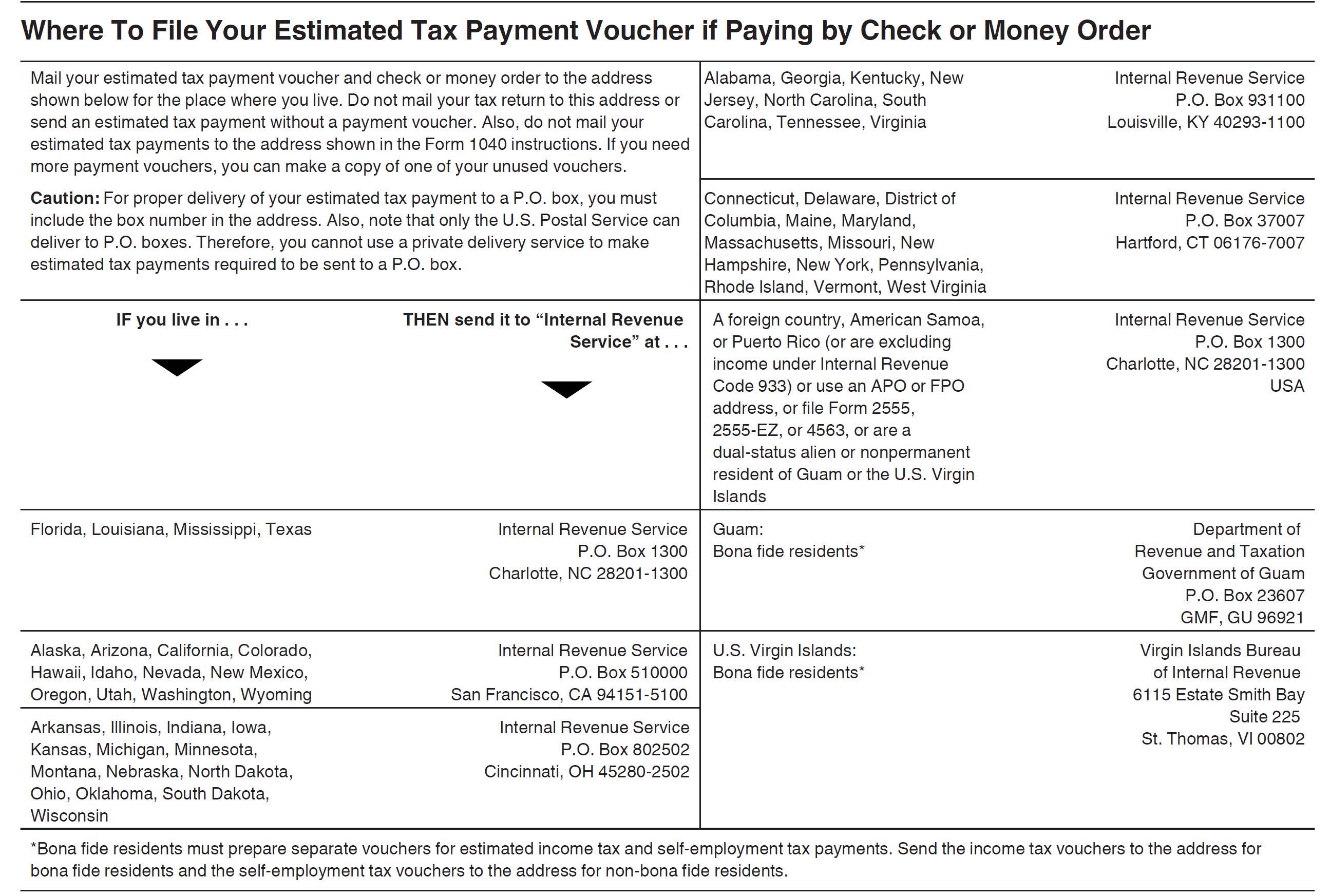

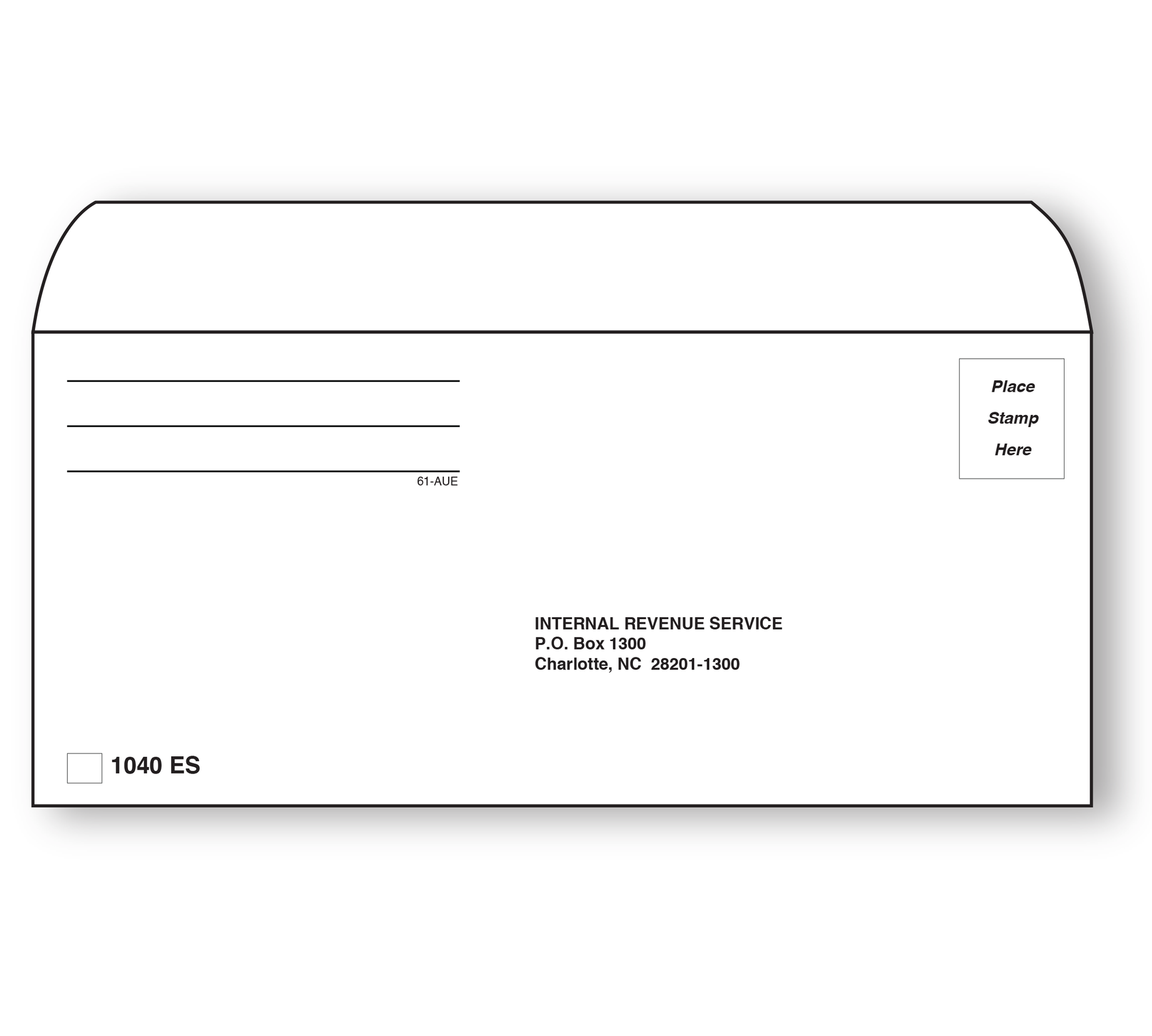

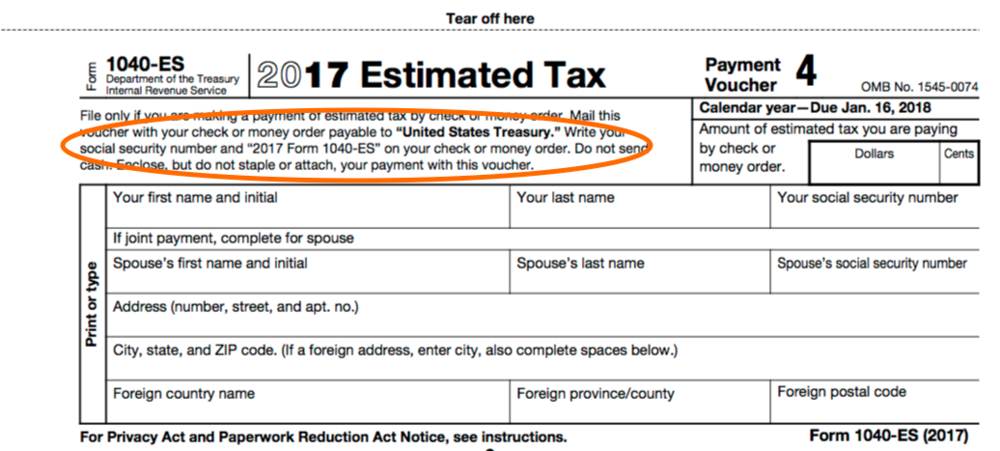

Where To Mail Quarterly Tax Payments? (Best solution) - Law info The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201- 1300 USA. To make your estimated quarterly tax payments by mail, tear off the voucher at the bottom of Form 1040-ES and mail it to the IRS. Include a check or money order for your payment.

Make a Payment | Minnesota Department of Revenue Individuals: Use the e-Services Payment System Some tax software lets you make or schedule payments when you file. To cancel a payment made through tax software, you must contact us. Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. Businesses: Log in to e-Services

PDF 2022 Form OW-8-ES Oklahoma Individual Estimated Tax Year 2021 Worksheet ... After this estimated tax payment is processed, you will receive a pre-printed coupon each quarter. Please use the pre-printed coupon to make further tax payments. Name Address City State IP 2022 Mail this coupon, along with payment, to: Oklahoma Tax Commission - PO Box 269027 - Oklahoma City, OK 73126-9027

home.treasury.gov › newsPress Releases | U.S. Department of the Treasury September 21, 2022 Biden-Harris Administration Announces Over $8.28 Billion in Investments in Community Development Financial Institutions and Minority Depository Institutions through the Emergency Capital Investment Program

How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ...

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

:max_bytes(150000):strip_icc()/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "38 irs quarterly payment coupon"