38 treasury bill coupon rate

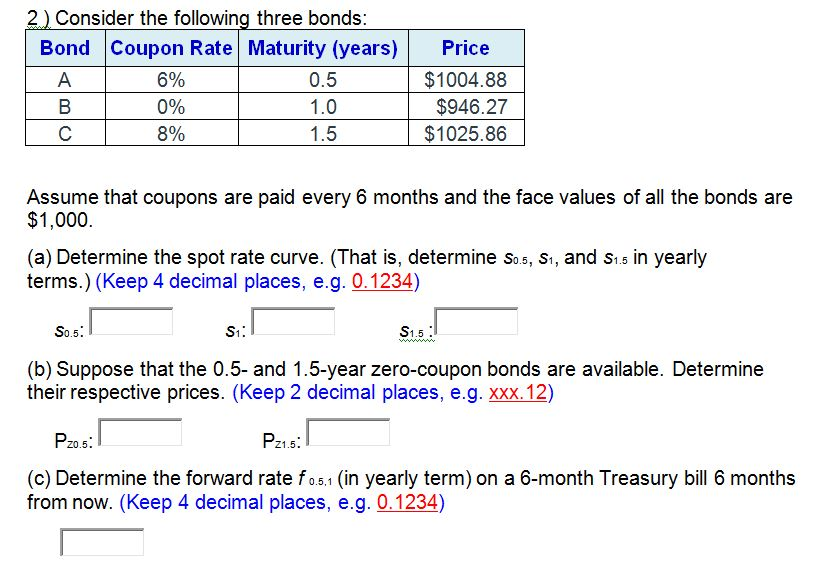

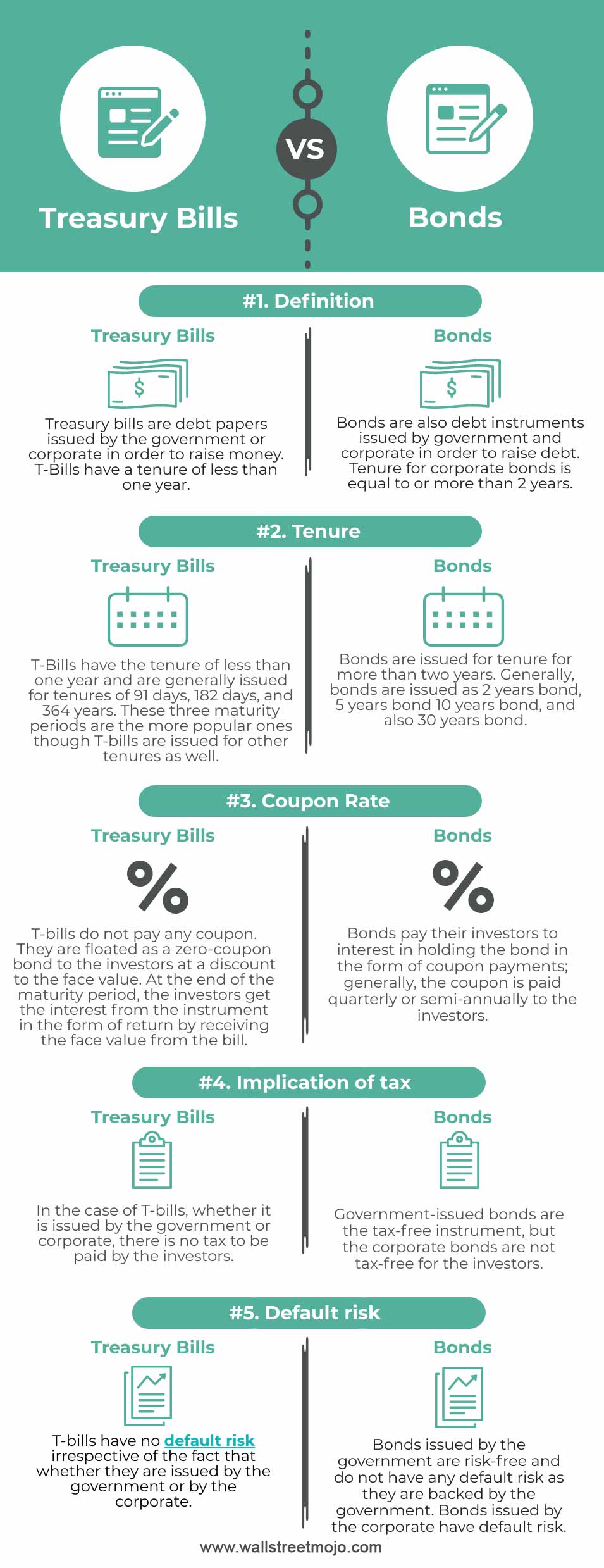

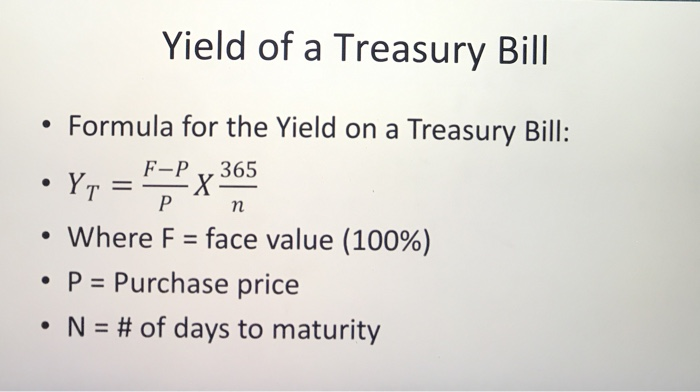

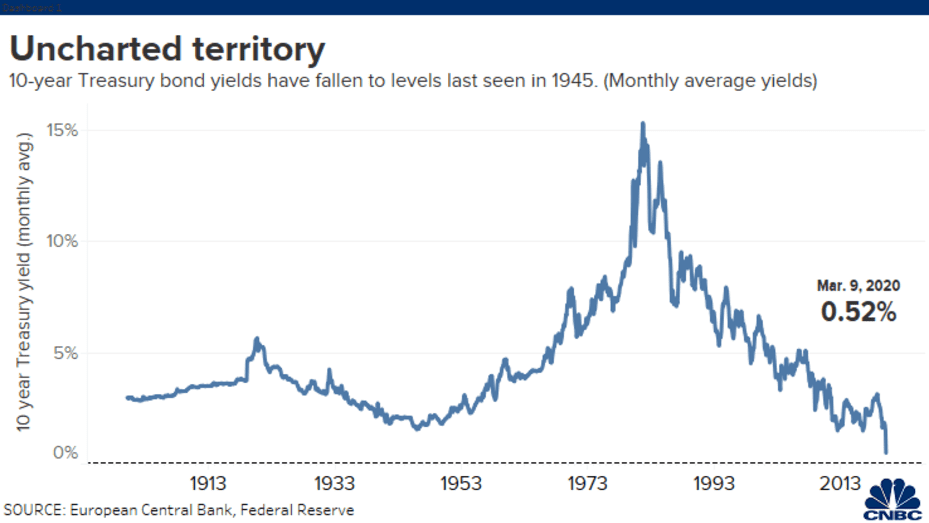

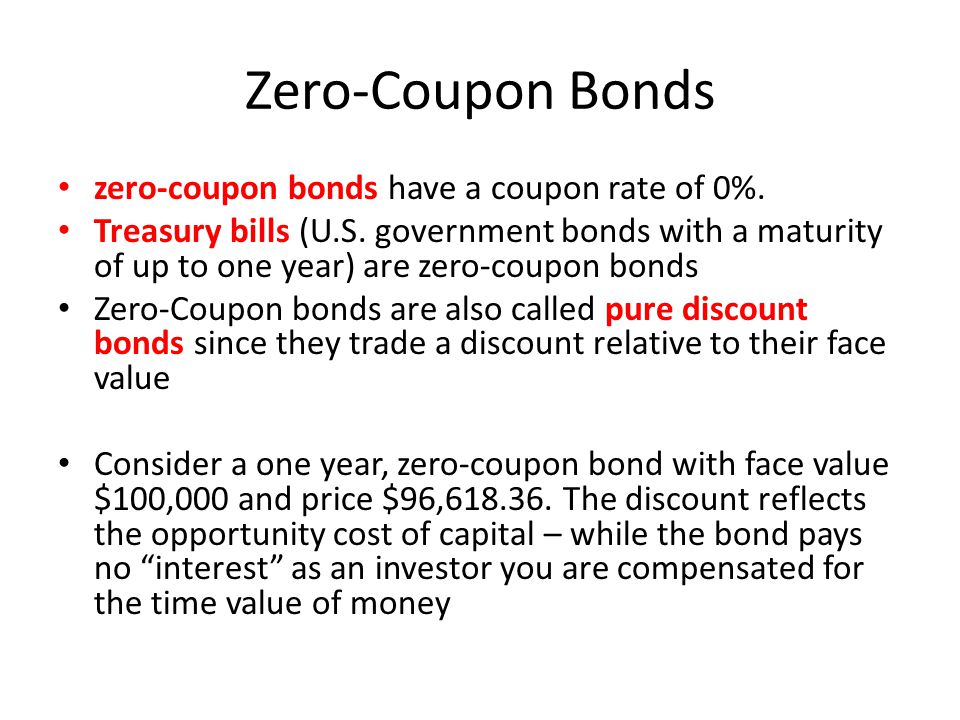

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 06, 2022 is 3.83%. Reserve Bank of India - Frequently Asked Questions Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of ₹100/- (face value) may be issued at say ₹ 98.20, that is, at a discount of say, ₹1.80 and would be redeemed at the face value of ₹100/-.

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo Treasury bills are a type of zero-coupon security where the central government borrows funds from the individual for a period of 364 days or less. In return, the investors receive interest. ... For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases ...

Treasury bill coupon rate

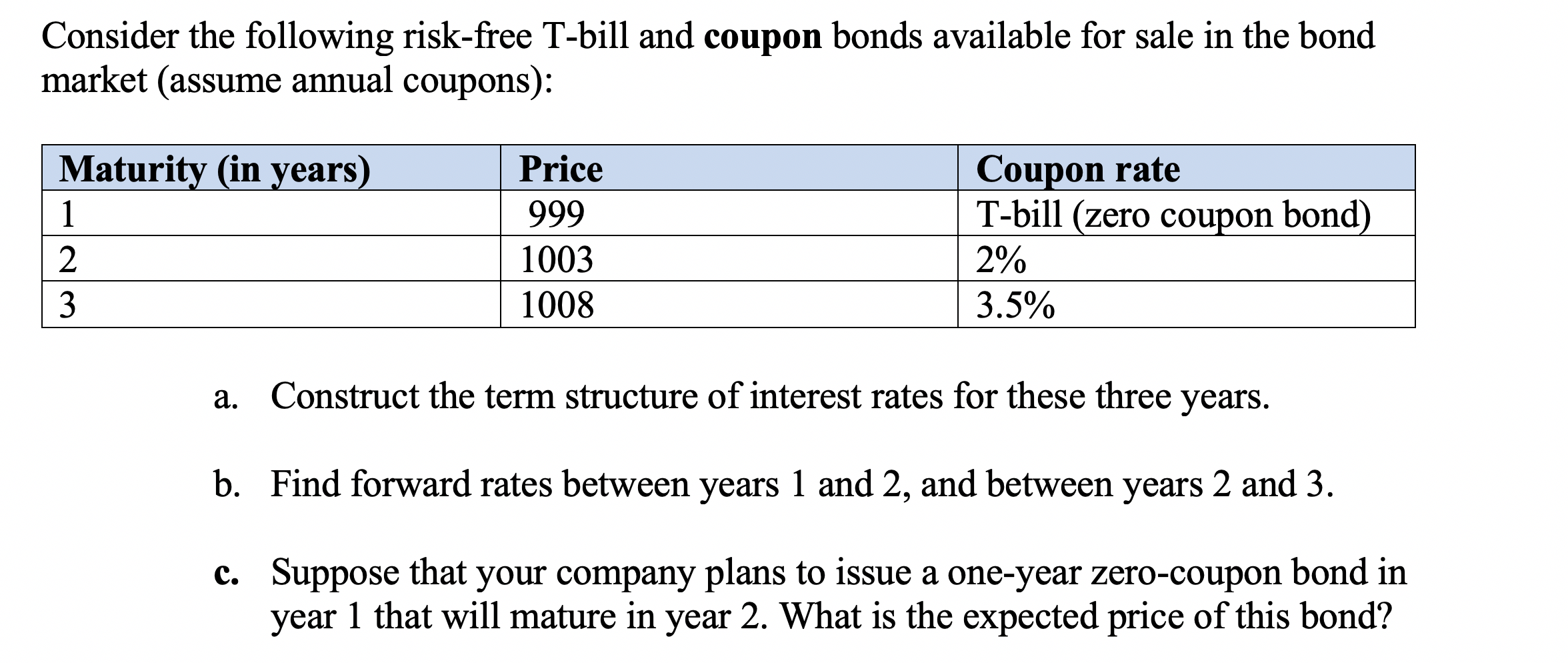

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond... Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so...

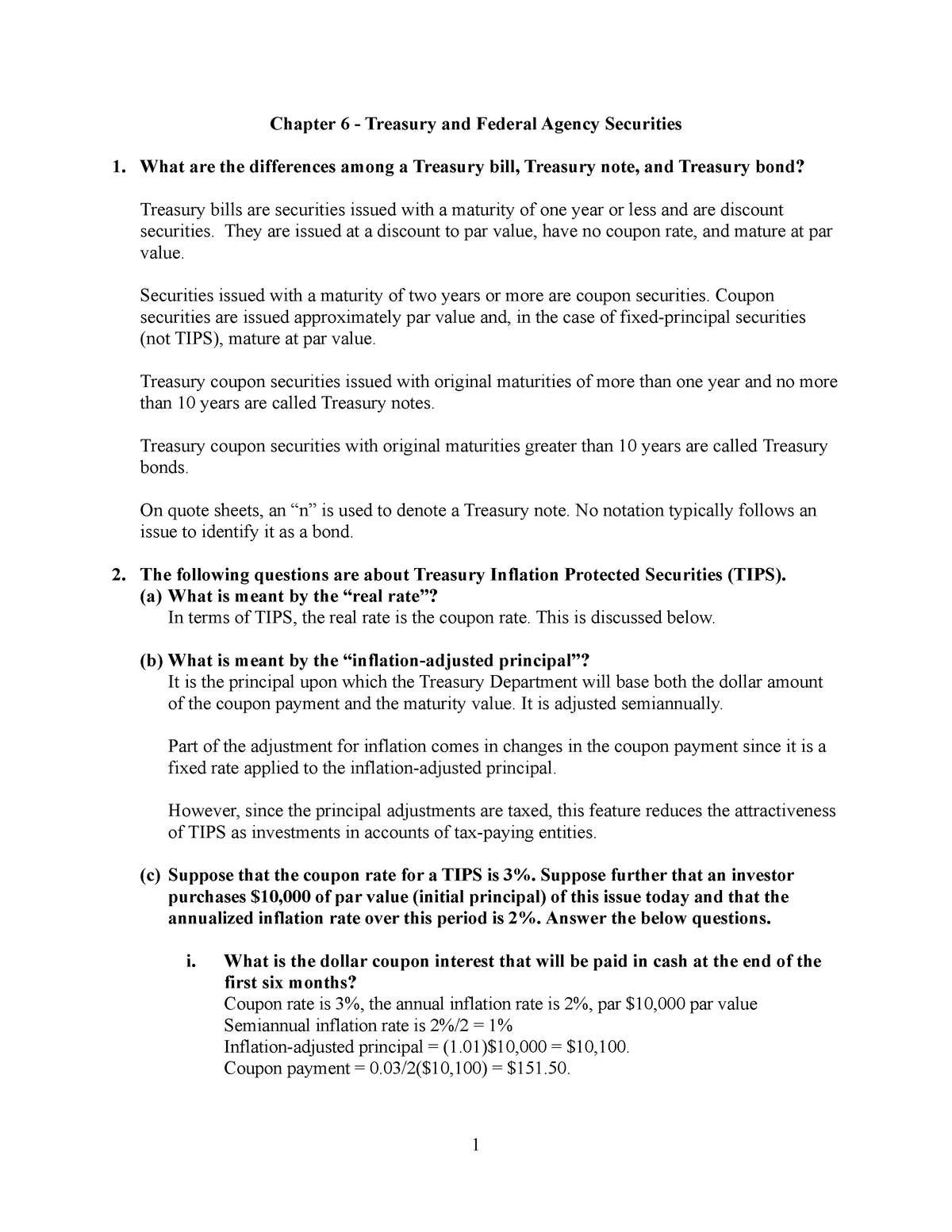

Treasury bill coupon rate. US Treasury Bonds - Fidelity US Treasury bills: $1,000: Discount: 4-, 8-, 13-, 26-, and 52-week: Interest and principal paid at maturity: US Treasury notes: $1,000: Coupon: 2-, 3-, 5-, 7-, and 10-year: Interest paid semi-annually, principal at maturity: US Treasury bonds: $1,000: Coupon: 20-year 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ... Specially Designated Nationals And Blocked Persons List (SDN) … Oct 06, 2022 · Last Updated: 10/07/2022 As part of its enforcement efforts, OFAC publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries. It also lists individuals, groups, and entities, such as terrorists and narcotics traffickers designated under programs that are not country-specific. Collectively, such individuals and … HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

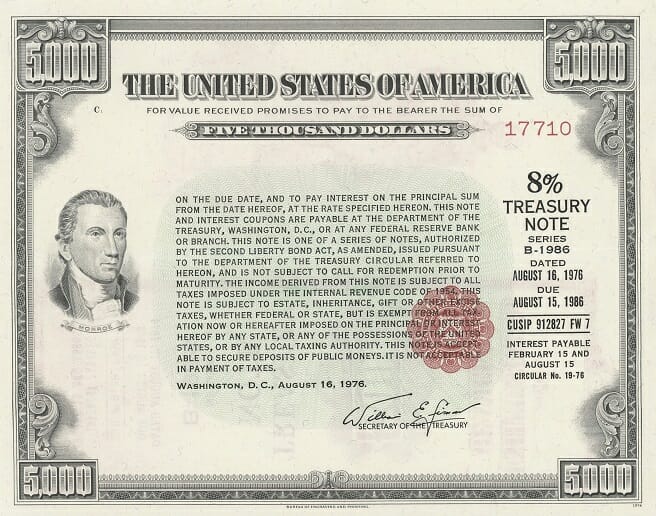

United States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction. en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction. Treasury Bills — TreasuryDirect Also see Understanding pricing and interest rates. Interest paid: When the bill matures: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency: Every four weeks for 52-week bills Interest Rate Statistics | U.S. Department of the Treasury Sep 30, 2010 · Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. ... View the Daily Treasury Bill Rates ... this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30 ...

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to its... Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch U.S. 1 Month Treasury Bill: 0.088: 2.957%: U.S. 3 Month Treasury Bill-0.018: 3.365%: U.S. 6 Month Treasury Bill: 0.042: 4.092%: U.S. 2 Year Treasury Note-0.030: 4.312%: U.S. 3 Year Treasury Note-0...

home.treasury.gov › policy-issues › financialSpecially Designated Nationals And Blocked Persons List (SDN ... Oct 06, 2022 · Last Updated: 10/07/2022 As part of its enforcement efforts, OFAC publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted countries. It also lists individuals, groups, and entities, such as terrorists and narcotics traffickers designated under programs that are not country-specific. Collectively, such individuals and companies are called ...

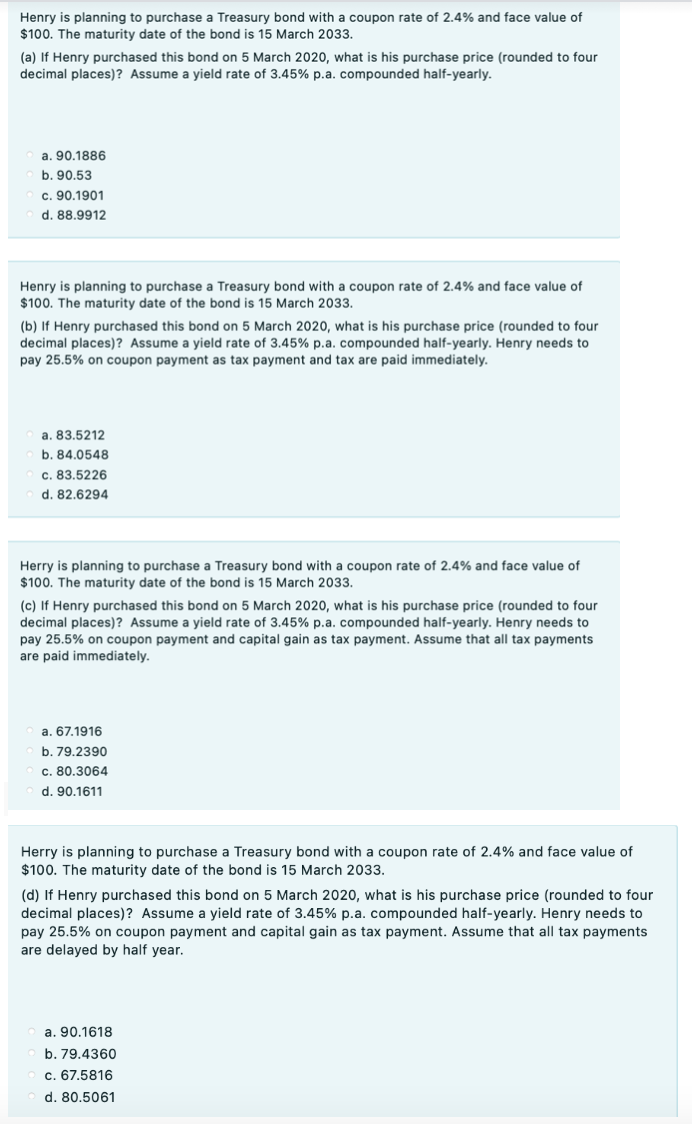

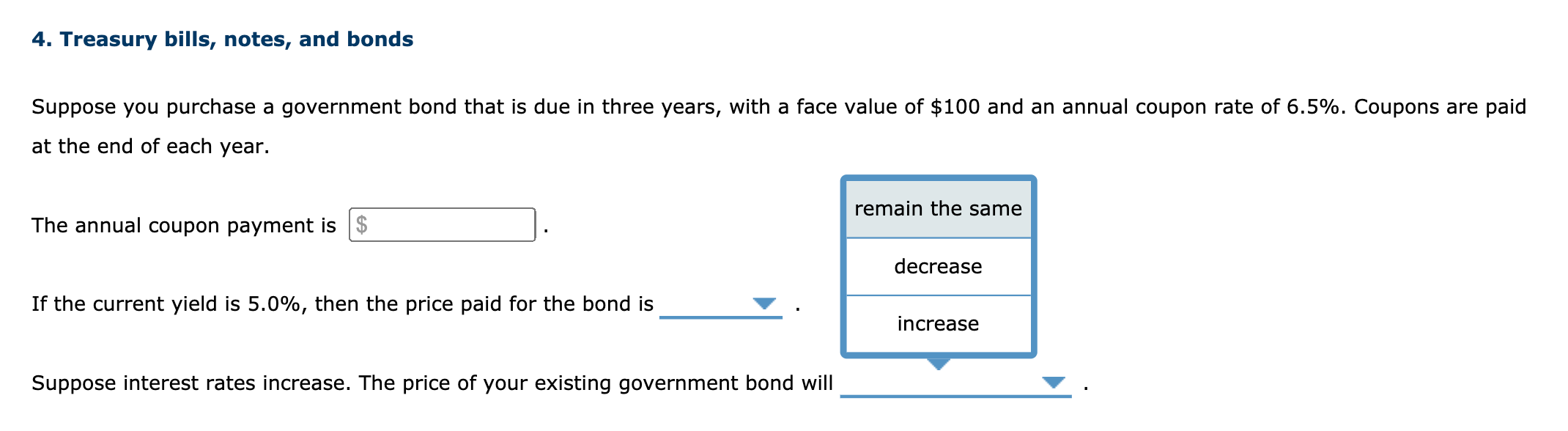

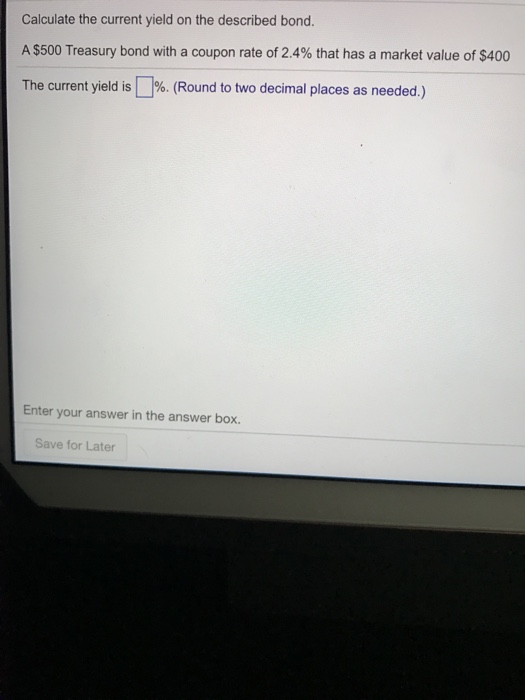

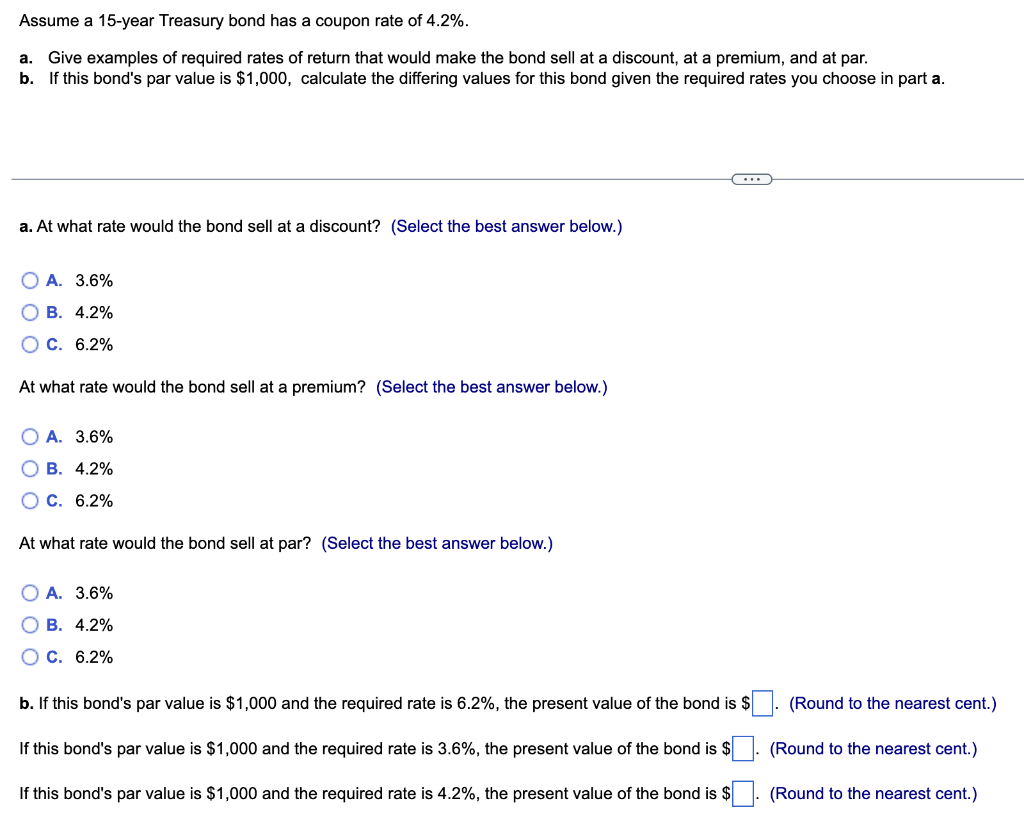

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. The bond sells at a discount if its market price is below the par value. In such a situation, the yield-to-maturity is higher than the coupon rate.

› 2016 › 10-year-treasury-bond10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 06, 2022 is 3.83%.

Resource Center | U.S. Department of the Treasury Resource Center. Download CSV. Select type of Interest Rate Data. Select Time Period. Date. 20 YR. 30 YR. Extrapolation Factor. 4 WEEKS BANK DISCOUNT.

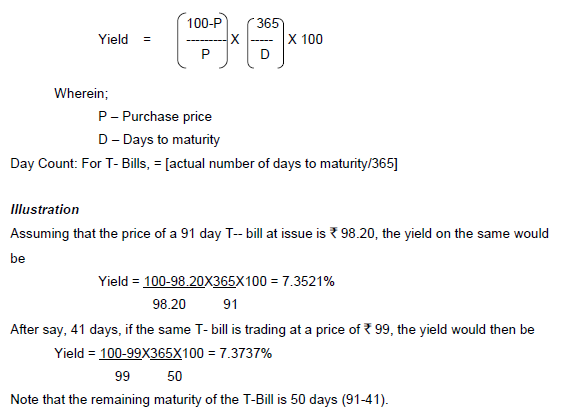

Price, Yield and Rate Calculations for a Treasury Bill Calculate … Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

What Is a Treasury Note? How Treasury Notes Work for Beginners A Treasury note is a type of U.S. government debt security with a set interest rate and a maturity period ranging from one to ten years. Interest rates are determined at the federal level, just like a Treasury bond or a Treasury bill. Treasury notes are highly common investments because they are available on the secondary market.

Treasury Notes — TreasuryDirect 4.25%. 102.106357. Above par price required to equate to 3.99% yield. Sometimes when you buy a Note, you are charged accrued interest, which is the interest the security earned in the current interest period before you took possession of the security.

Coupon Equivalent Rate (CER) Definition - Investopedia Its coupon equivalent rate would be 8.08%, or ( ($10,000 - $9,800) / ($9,800)) * (360 / 91), which is 0.0204 * 3.96. Compared with a bond paying an 8% annual coupon we'd choose the zero-coupon bond...

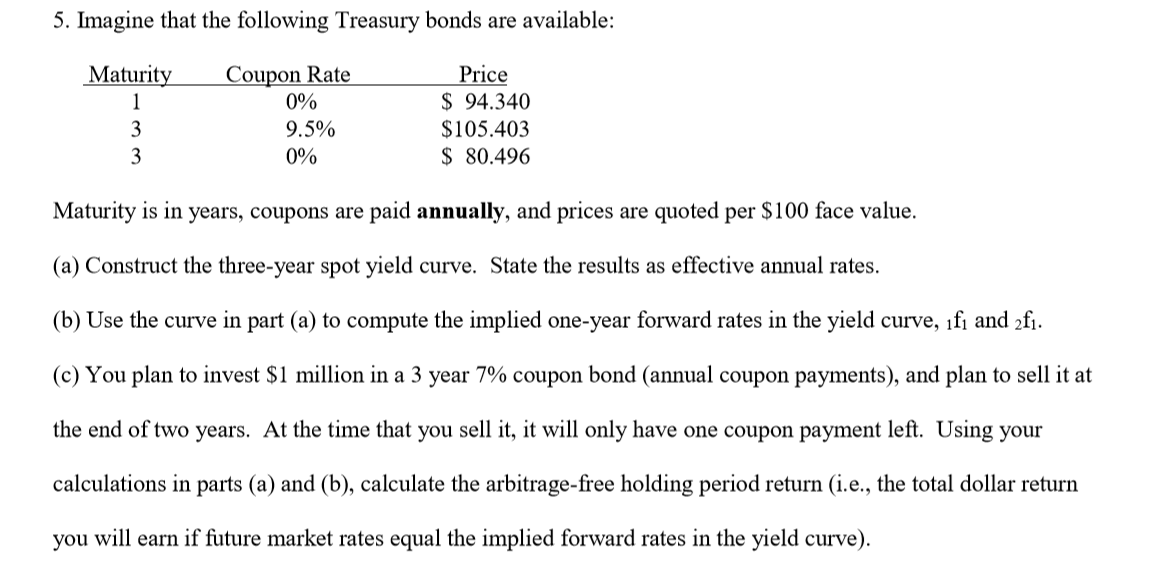

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury …

Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: Price = 1000 (1 - (.00145 x 180)/360) = $999.27; The formula shows that the bill sells for $999.27, giving you a discount of $0.73. Bonds and Notes

PDF Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity For bills of more than one half-year to maturity i = (2) a =

Coronavirus State and Local Fiscal Recovery Funds Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues ... States that have experienced a net increase in the unemployment rate of more than 2 percentage points from February 2020 to the latest available data as of the date of ...

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on February 2022 changes to XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are ...

› government › organisationsHM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

United States Rates & Bonds - Bloomberg 1 Month. 1 Year. Time (EDT) GB3:GOV. 3 Month. 0.00. 3.26. 3.33%. +32.

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? The T-Bill pays no coupon—interest payments—leading up to its maturity. T-bills can inhibit cash flow for investors who require steady income. T-bills have interest rate risk, so, their rate could...

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

Post a Comment for "38 treasury bill coupon rate"